THE 5 MINUTE FRACTIONAL CFO

046: A $500,000 Client Success Story (Here's How They Did It)

May 28, 2023Subscribe to the Newsletter

Join 3,500+ readers of The 5 Minute Fractional CFO newsletter and learn how to start, scale or optimize your Fractional CFO services.

In December 2022, one of my firm's clients was able to pay out $500,000 in holiday bonuses to their employees.

This is alone is amazing. But even more so when you consider the fact that 2 years prior they weren't even profitable.

For my firm, this is the exact type of impact we want to have for our clients. Yes, it's true that we want the owners to generate more income for themselves. But we also want to see that trickle down to their employees and their families!

How did my firm help them realize this amazing turnaround and the resulting impact?

It wasn't a result of:

• More charts

• Increasingly prolific KPIs

• Extra deliverables and more calls

• Adding bookkeeping to our scope of work

Increased impact is rarely a function of increased complexity. In fact, more often than not, the inverse is true!

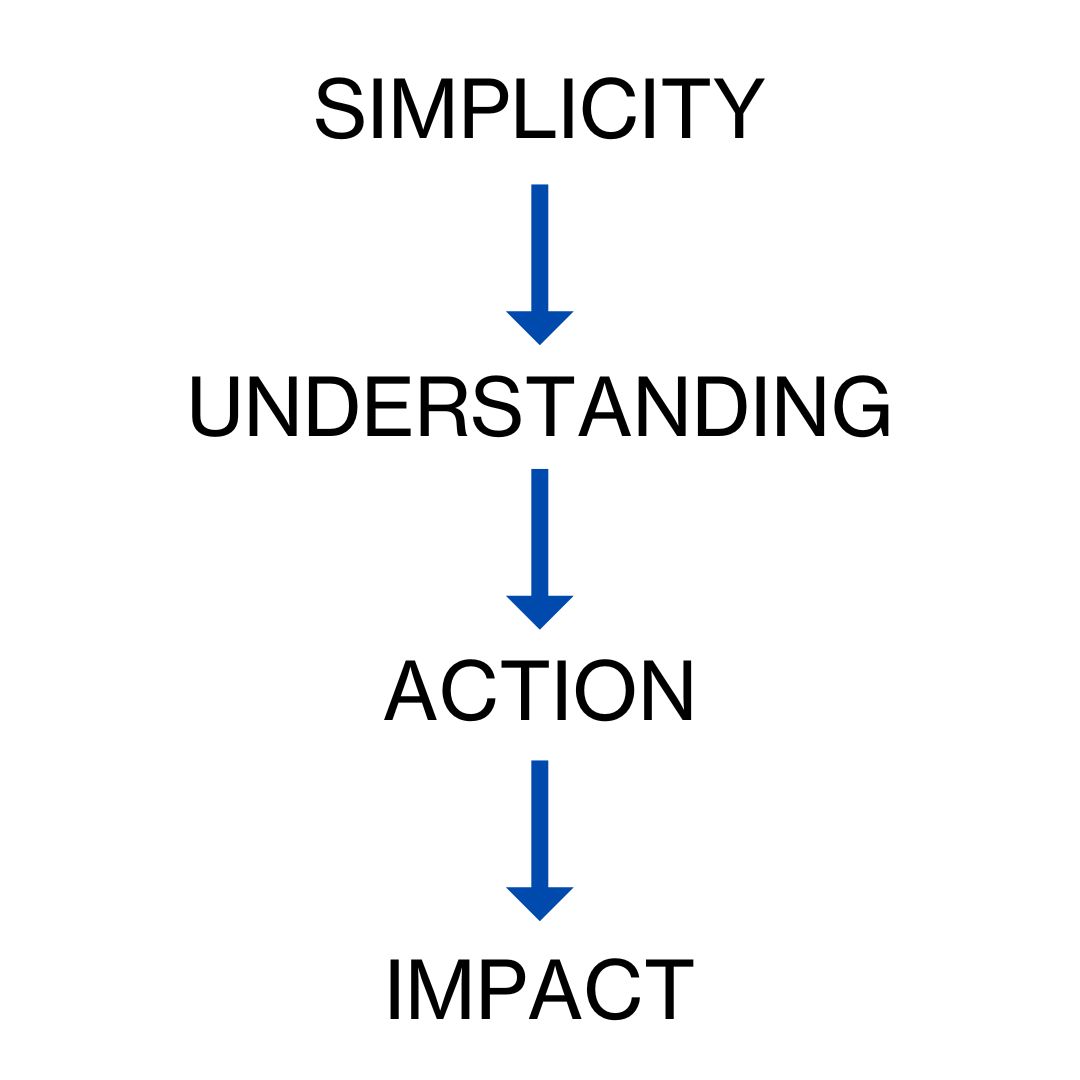

I realized years ago that there's a simple formula that we have to follow that leads to impact.

In order for us to create outcomes and impact for our clients, they have to first take action. In order for them to take action, they must first understand what it is we're asking them to do (and why). And in order for them to understand what we're asking them to do (and why), we have to simplify what we're telling them.

Let's explore each of these in more detail:

SIMPLICITY:

As an industry, we're guilty of overcomplicating two key things:

1. What we're telling our clients

2. What we're delivering to our clients

We explain concepts and ideas to our clients the same way we'd explain them to our peers. But the reality is that our clients don't need that level of explanation. In fact, when we go that deep, they usually get confused and check out.

A CFO superpower is the ability to take our deep understanding of finance and break it down so a 7th grader could follow along. We need to give them just enough that they can make better decisions with what we're sharing.

We also overcomplicate our deliverables. We want to give our clients everything we've got! Charts and graphs and KPIs, oh my!

But most of those things only serve as distractions from what our clients really need to be focused on.

Pick the critical few items, 4-6 is best, that they need to focus on to get results.

You can (and should) monitor the other 58 KPIs behind the scenes. Use surgical precision to chose the ones your clients see.

UNDERSTANDING

The primary reason simplicity is so important is because simplicity leads to understanding.

When we share 58 different "things" with our clients, the picture becomes muddied. How does it all related to their goals and pain points?

But, with the right 4-6 ideas or metrics explain simply, the client can understand and then take action.

ACTION

Everything hinges on action!

If our clients aren't doing things differently than they would have without us, then what are we even doing?!

We have to be able to show them how our suggestions will result in them achieving their goals faster.

In fact, a disconnect here is the number one reason our clients don't take our advice.

You must tell the story.

But how?

This is where forecasts and projections become so powerful.

SHOW them how what your suggesting will impact profitability or cash flows. Show them how that will enable them to (insert client goal here) faster or with less risk.

IMPACT

This is what makes it all worthwhile for me.

The client that I mentioned at the top of this blog spent 2 years taking action.

They:

• Fixed a nasty WIP report

• Created processes to reduce waste

• Negotiated more favorable terms with vendors

• Invested in training for their estimators and project managers

Why?

Because each month, we worked with them on a small handful of items that they needed to focus on.

We showed them how each would impact their P&L and balance sheet.

We broke the concepts down into bite-sized, easily-digestible, and understandable bits.

And in under 2 years, they're a huge success story. And we were able to be their guide in that success.

Do you want to be a guide in our clients' impact stories?

If so, ask yourself three questions:

What can I simplify?

How can I help my clients better understand?

How can I lead them to take action?

Then, sit back and watch the impact unfold.

📌 ATTENTION NEW FIRM OWNERS! 📌

If you're thinking about starting a firm OR if you've recently started your firm, you need to read this!

We just launched our brand new program called Inner Circle Fast Track.

It's designed specifically for those of you who have recently launched your firm or are thinking about launching in 2026.

It includes access to my private community and my coaching program called Inner Circle. You'll get access for an entire year PLUS you'll get my step-by-step training on how to scale a firm from $0 to $1M as well as my LinkedIn Sales Navigator training (how to laser target leads for your firm). I even have an optional add-on that includes my step-by-step prospecting and sales training.

If finding leads and closing leads is a problem THIS IS FOR YOU.

It's on sale THIS WEEKEND ONLY for less than you could normally purchase Inner Circle alone for.

Check it out HERE.

PS - YES! It comes with a 30-day MONEY BACK GUARANTEE.